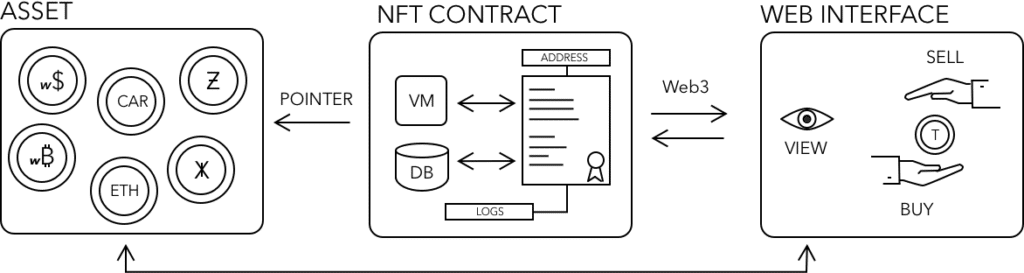

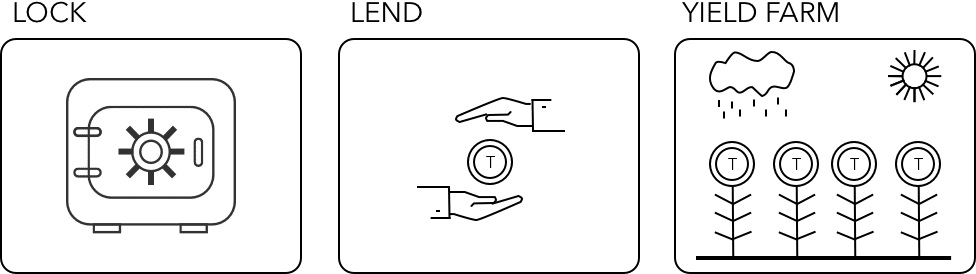

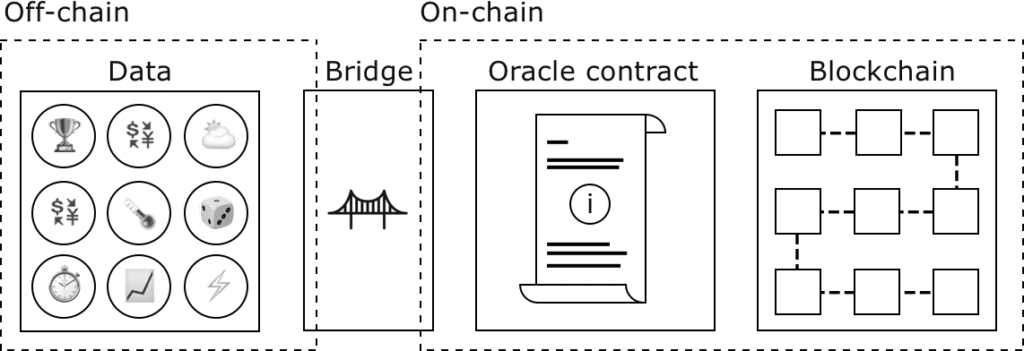

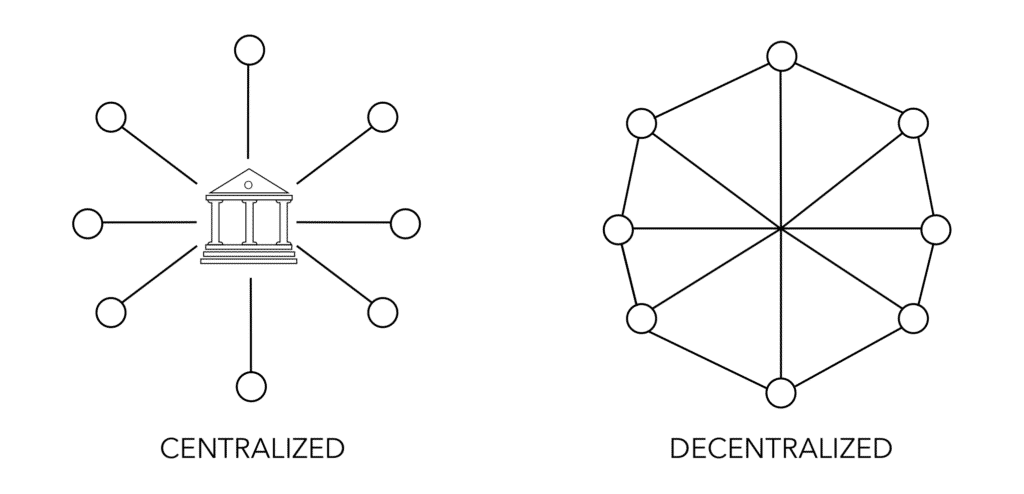

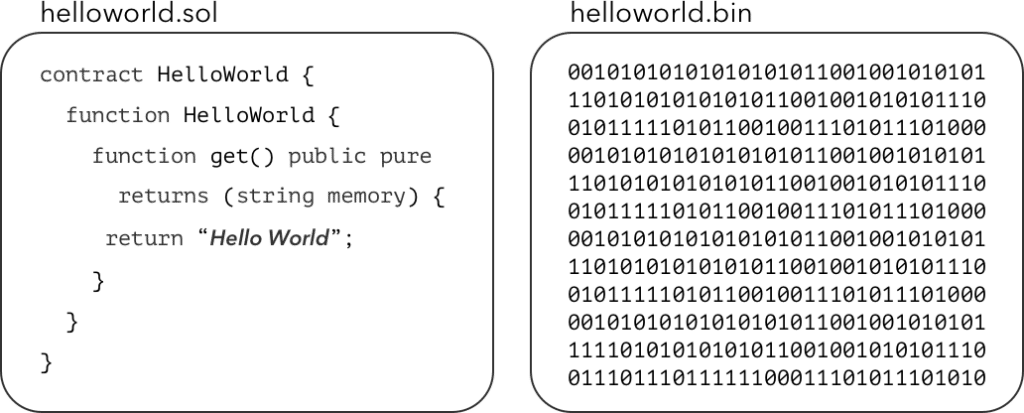

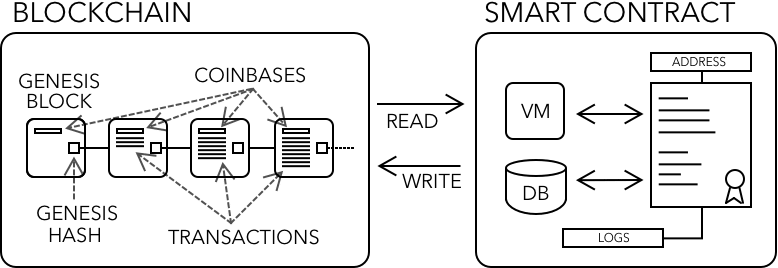

DeFi book describes DeFi as short for Decentralized Finance. DeFi combines blockchain technologies with smart contracts to create a novel financial ecosystem. This new ecosystem replicates and complements many existing financial services and products. It also enables a completely new set of innovative services and products that are available to anyone, anywhere, at anytime!

In DeFi, participation is permissionless, and anyone is free to join. Anyone can also issue new tokens and trade them as they wish. These tokens can represent anything from currencies, properties, special rights or accesses, artwork, or any asset class, whether physical or digital.