Tokens are the foundational units that enable DeFi. They can represent anything from a currency, deeds to a property, memberships, or certain rights (e.g., voting).

In DeFi, Tokens are typically issued, distributed, and managed with several deliberate properties to incentivize specific outcomes. These properties may include:

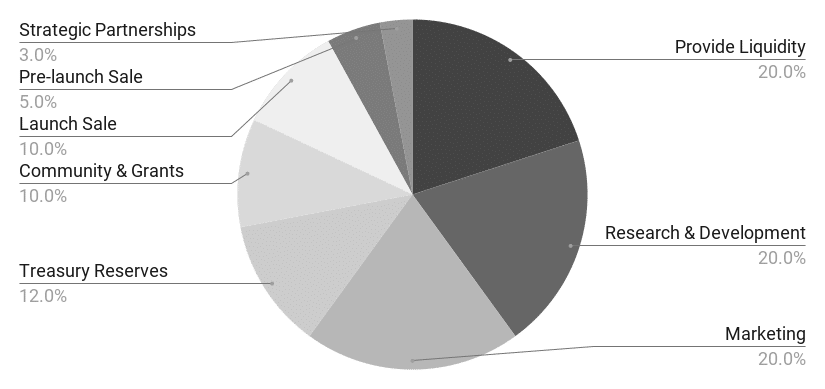

One example of a token distribution to incentivize the development of a project and establish a community may have a distribution similar to:

In this token distribution example, there is a strong focus on development and marketing. It is also assumed that the project will have a pre-launch sales to reward earlier proponents.

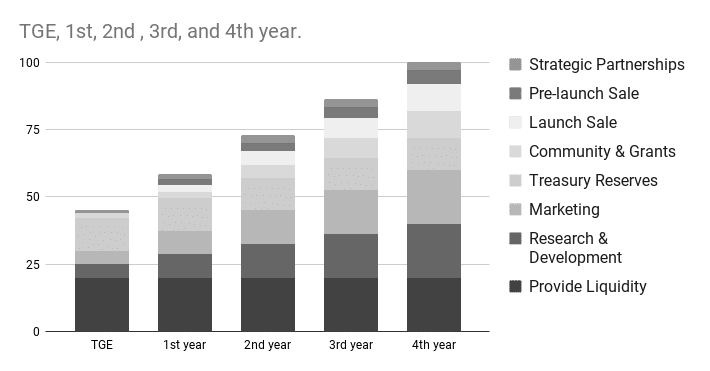

This type of token distribution typically includes vesting periods to create longer-term incentives and prevent tokens from being dumped shortly after issuance. One example of such a vesting period, after the Token Generation Event, can be described by the following plot:

Some tokens are immediately made available in this example, while others are only fully vested after four years.

Some may say that vesting periods of four years (typical in Venture Capital) feel like an eternity in the fast-paced crypto space. Therefore it is likely that most vesting periods will be relatively shorter

The basic life-cycle of a token includes issuance and transfer/s. More advanced features may include merges, splits, wrapping and unwrapping, rebases, burns, and sometimes even resurrections (e.g., through forks).

- total amount to be issued;

- schedule of issuances;

- distributions at launch;

- vesting and other locking periods;

- rebases to adjust supply;

- buy-backs; and

- burns.

Tokens are issued and managed by smart contracts and typically follow a standard defined by ERC20, ERC721, or ERC1155.

This field of issuing tokens, and creating the right economics to balance short-term rewards versus long-term incentives is still relatively new. Therefore, new concepts, standards, and mechanisms will likely be developed and introduced.