This article debunks a number of common misconceptions that exist in relation to crypto and blockchain, including:

- Crypto No Has Utility

- Crypto Is Not Backed By Anything

- It Is Too Late To Buy Crypto

- Crypto-miners Solve Complex Problems

- Crypto Is Great For Criminals

- Crypto Is Bad For The Environment

- Crypto Brings No Genuine Solution/s

- Crypto Is A Currency Or/And A Commodity

- Blockchain As The Breakthrough Innovation

- Crypto Requires More Regulation

1. Crypto Has No Utility

Cryptocurrencies like Bitcoin and Ethereum incentivize the protection of a decentralized datastore (e.g., a ledger/blockchain) that is transparent and open.

Owning the relevant crypto is also a prerequisite for anyone desiring to write to these secure datastores.

The applications of a secure database that is easily readable by anyone, at any time, from anywhere, are boundless. However, most databases, including those that keep track of ownership (e.g., land registries, bank accounts, intellectual property, etc.), are unsafe and can be easily manipulated by a relatively small number of bad actors, including corrupt/coerced administrations.

Crypto is also required to execute any computation (e.g., algorithms that implement smart contracts) that creates, updates, or deletes entries on these special datastores.

These smart contracts can implement a diverse range of services, from simple time-stamping services to enabling completely new digital economies.

2. Crypto Is Not Backed By Anything

As described in 1, crypto is naturally backed by those who utilize the services it enables. It is also backed by a wider range of individuals and organizations for a myriad of reasons. These reasons may include:

- interest in innovations and exploring new possibilities;

- wish to have a complementary decentralized financial system;

- wish for self-sovereignty and/or self-custody;

- distrusts of other administrators and their current and/or future policies;

- enablement and inclusion of more individuals and fairer access to financial instruments.

There are many more exoteric reasons to back crypto, including futuristic sci-fi scenarios involving artificial intelligence transacting directly without the need for intermediaries or processes that apply mainly to humans (e.g., KYC/AML, etc.), and many others that we cannot even imagine.

3. It Is Too Late To Buy Crypto

Since the price of Bitcoin has surpassed thousands of dollars, many believe they have missed the opportunity to buy. However, this is not true because most crypto-currencies are divisible to tiny fractions that can also be bought.

For example, Bitcoin’s smallest unit is 0.00000001 (one Satoshi), which at the price of 1 million dollars per Bitcoin would still cost only a cent!

4. Crypto-miners Solve Complex Problems

It is commonly said that crypto-miners solve complex mathematical problems. This assertion is incorrect and demonstrates a lack of understanding of the internal mechanics of crypto mining.

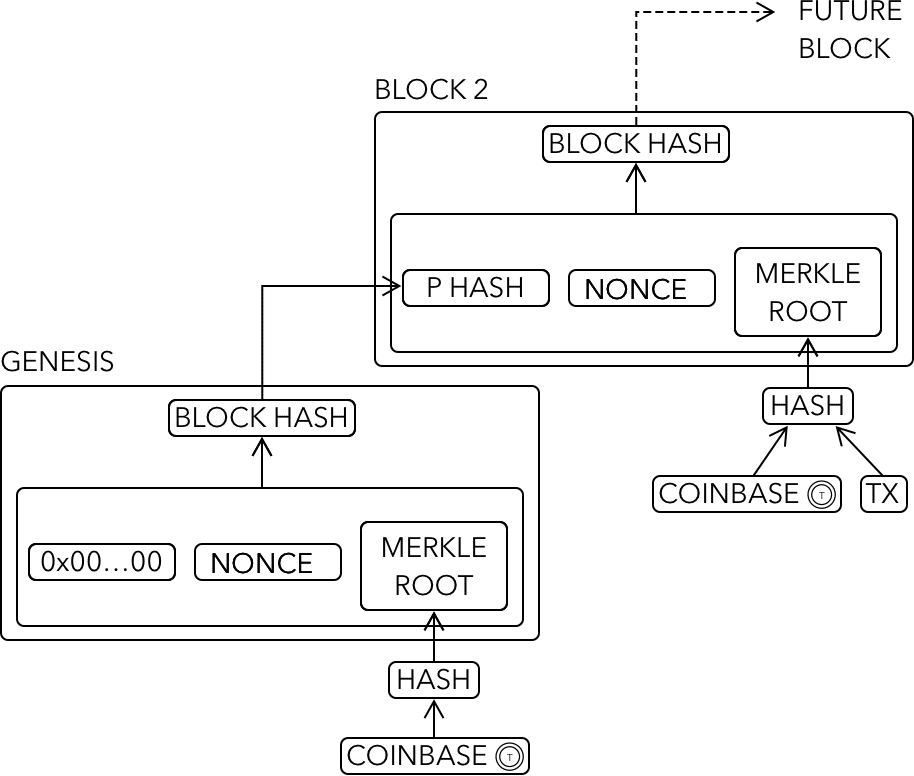

The mining process mainly consists of generating sequential blocks that record valid transactions, and verifying these transactions merely involves checking that the sender has the required funds. All these operations require only trivial checks and math operations.

However, well-designed crypto-systems limit the rate of transactions to prevent their data store from growing too fast. For example, Bitcoin ensures that a new data block is generated on average every 10 minutes and that each block is no larger than 2MB. Limiting the pace of growth is important so that anyone with an average computer can participate (instead of restricting access to only those with supercomputers).

To enforce this limited growth rate of, on average, 2MB every 10 minutes, Bitcoin introduces a difficulty mechanism that increases or decreases dynamically based on the hashing power available. If there are many miners (i.e., high hashing power), the difficulty of generating a block goes up, and vice-versa.

This difficulty mechanism calibrates the probability of finding a valid block, within a certain time frame, by requiring that the hash of a new block start with a certain number of zeros. For example, when there are very few miners, a block-hash may look like this:

When there are many miners with high hashing capacity, a valid block-hash, will require significantly many more leading zeros to be considered valid. For example:

Finding a valid block-hash that starts with the required number of zeros, as set by the difficulty mechanism, involves picking a random number, including it in the header of a new candidate block, and generating a hash of the entire block.

If the resulting hash starts with the required number of zeros, then a valid block has been created/mined. If it is not, another random number needs to be selected, and the process is repeated until a valid hash is found.

This mining process is more akin to rolling the dice and hoping that the resulting hash matches a lottery number (i.e., starts with the required number of zeros) instead of solving a complex mathematical problem!

One important aspect to note is that this difficulty mechanism is crucial to determining the chain’s trustworthiness since the chain that is the hardest to compute (e.g., used most hashing power) is the one that is considered the most trusted.

5. Crypto Is Great For Criminals

Most crypto-currencies are terrible for conducting illegal activities because every transaction is recorded, and the origin of any coin can be trivially traced.

As digital forensics technologies improve, it will also become easier to uncover the culprits behind past illicit activities.

We can already see this in effect with so many illegal activities that used crypto-currencies being shut down by law enforcement. Even corrupt officials are not immune to the transparency of blockchains as evidenced when rouge federal agents were caught stealing Bitcoins seized during the shutdown of a dark web marketplace (Silk Road).

6. Crypto Is Bad For The Environment

Participants in crypto-systems use one of several consensus schemes to agree on which blockchain should be considered the most trustworthy. Examples of such schemes are:

- Proof-of-Work (PoW)

- Proof-of-Stake (PoS); and

- Proof-of-Authority (PoA).

Of all these schemes, PoW is generally the one disputed as wasteful.

Even though PoW mining provides a way to convert electricity into money, it still follows a rational economic model. When electricity is cheap enough, it becomes profitable to mine. Conversely, it becomes uneconomical to mine when electricity is too expensive.

At high energy prices, it becomes more rational to buy the crypto-currency directly from the market or from someone who can mine it more cheaply.

This market dynamic means that crypto mining tends to move to locations where energy generation is efficient and cheap. Sometimes, this mining even happens with energy that is going completely to waste (e.g., reusing gas that would be flared or renewable energy that cannot be stored).

PoW also incentivizes the invention and development of new power sources that are extremely cheap and sustainable (e.g., geothermal power plants).

In addition to promoting better energy sources, PoW also drives innovation in more efficient/faster hardware designs. These incentives result in many higher-order benefits that are unquantifiable.

It is also important to appreciate that PoW is the most decentralized, secure, and inclusive consensus method. This is because the other schemes require buy-ins (e.g., staking tokens) or some (centralized) authoritative entity/ies.

7. Crypto Brings No Genuine Solution/s

The fundamental innovation that enabled the crypto ecosystem to flourish is the ability to trust a decentralized database (i.e., blockchain) and computations (e.g., smart contracts).

There is an argument that the same operations can be done much more efficiently using centralized solutions, but this is missing the crucial advantages of an incorruptible distributed and decentralized system.

With this new decentralized paradigm, a wide range of services has been introduced that are faster, cheaper, and safer than most traditional systems. These services range from remittance, lending, borrowing, trading, investing, speculating, and trading novel digital goods.

There are also unique new concepts, such as flash-loads and other composable operations that can happen within the same block time.

8. Crypto Is A Currency Or/And A Commodity

Using traditional mental models and boxing crypto assets into a pre-existing asset class is unwise. Effectively, a crypto token is just an entry in a database, and this entry can represent any type of asset, including:

- property, voting, or membership rights;

- a currency that may or may not be a crypto-currency;

- a deposit, debt, or any other promise or obligation; or

- a mapping between two different domains.

Another fascinating aspect is that crypto tokens can combine different properties simultaneously. For example, a specific token can give voting rights, be traded as currency, and award a share of the revenue from its associated project. In this case, this token can be viewed as both a currency and security.

Given all the applications, uncertainties, and risks associated with these nascent technologies and crypto-tokens, it is no surprise there is so much confusion and misunderstandings.

9. Blockchain As The Breakthrough Innovation

It is common to hear high-profile individuals say they do not believe in crypto, but blockchain technology is transformational. Unfortunately, such assertions immediately demonstrate a lack of understanding of the mechanics that make this type of blockchains special (and secure).

The word blockchain has become synonymous with the technology underpinning crypto-systems. However, the concept and application of blockchains, in the strict sense of a chain of linked blocks, existed well before the introduction of Bitcoin (the first breakthrough crypto-currency).

One classic example of a blockchain is an accounting ledger that has existed for millennia. In these types of ledgers, pages, chapters, or books can be considered blocks, and each block is linked by a number (typically a sequential number or/and a running sum). Other examples using the concept of blockchains include: BitTorrent (2001); Git (2005); and Btrfs (2009).

If blockchains have existed before, why have they become such a buzzword? In part, the use of the word blockchain started as a way of distinguishing between the technology underpinning Bitcoin and its implementation (and associated currency). Still, it completely misses where the true innovation occurred, perhaps because it is easier to visualize a chain of blocks than to comprehend how hashing functions are used to verify data integrity and reach consensus without any centralized authority.

Reaching consensus, in the context of blockchains, is synonymous with determining which chain of blocks should be considered the truth when multiple different chains are presented. In the case of Proof-of-Work chains like Bitcoin, it is the chain that required the most work (i.e., hashing power to compute).

10. Crypto Requires More Regulation

It has become common to hear, “crypto needs more regulation“. However, it is important to distinguish what this means because it can vary widely from “we need more enabling clarity” to “we need to criminalize and stop it altogether”. Another interpretation is that the person saying it does not understand crypto enough, and does not have the will or time to understand it, so they are putting the onus of figuring out what is good or bad on someone else.

Financial regulations exist mainly for three reasons:

- Protect the users from scams, frauds, market manipulation, illegal activities, and/or other undesirable outcomes.

- Create clarity on what, when, how, and why something is allowed or disallowed and the consequences of such activities.

- Create incentives and/or taxation for certain activities.

Regulations can also exist to protect incumbents and make it harder, if not impossible, for competition to flourish. These types of regulations tend to be unfair, stifle innovation, and lead to poorer societies.

One of the main challenges with regulating crypto is that it can take many properties simultaneously, making the application of existing rules and regulations a matter of subjective interpretation.

The current lack of legal clarity allows scammers and fraudsters to operate in ambiguity and scare off those who would genuinely build legitimate businesses (e.g., raise capital for an endeavor in exchange for tokenized equity).

Perhaps one easy way to protect consumers is to classify the entire industry as a casino and warn any participant that they will almost certainly lose all that they put in. This way, innovation will be allowed to flourish while removing the expectation of any profits/returns.