A Decentralized Exchange (DEX) is a service that allows participants to list and exchange assets directly and openly. DEXs are implemented on-chain using smart-contracts. Using these decentralized applications (DApps) it is possible to list, buy, and sell any type of asset, including cryptocurrencies, stocks, or any other type of securities.

Exchanges can be broadly classified into two categories:

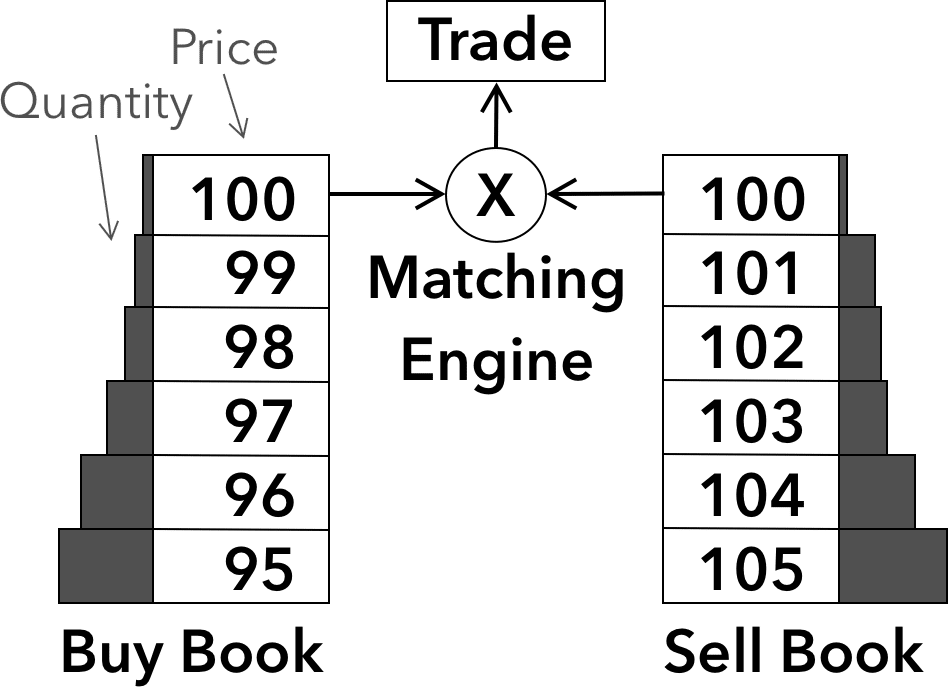

- Order book exchanges: An order book exchange is a type of exchange that operates by matching buyers and sellers based on their orders. Buyers place orders to buy an asset at a specific price, and sellers place orders to sell an asset at a specific price. The exchange matches the orders and executes the trade when the bid and ask prices cross (i.e., a buyer is willing to pay at least the same price as a seller is willing to sell). Examples of order book exchanges include traditional stock exchanges like the New York Stock Exchange (NYSE) and cryptocurrency exchanges like Coinbase and Binance.

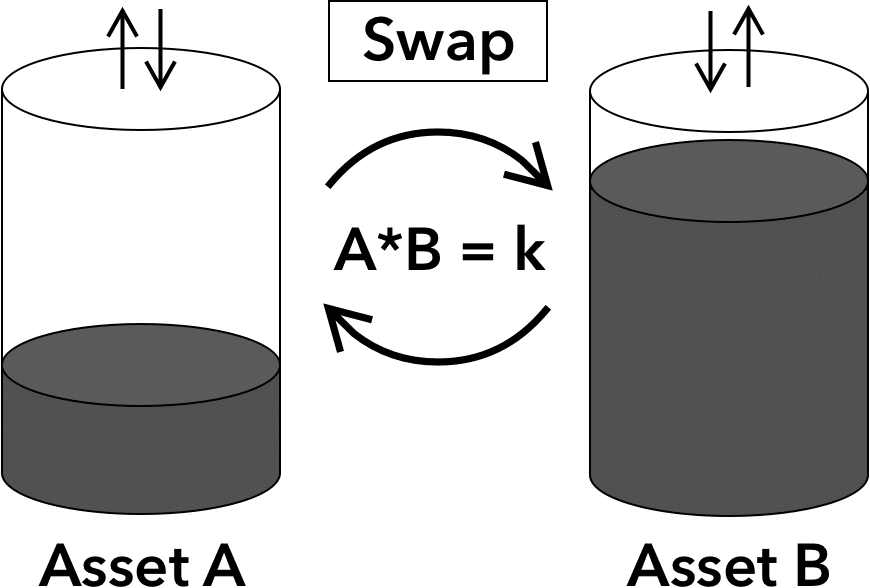

- Automated Market Makers (AMMs): Automated Market Makers are a type of exchange that operates using algorithms to automatically set the prices of assets based on supply and demand. AMMs do not use an order book to match buyers and sellers. Instead, they use a simple algorithm to calculate the price of an asset based on the amount of it that is being bought and sold. Examples of AMMs include UniSwap and SushiSwap in the cryptocurrency space.

DEXs typically contrast with Centralized Exchanges (CEXs) for several reasons, including:

- DEXs allow anyone to list assets and provide liquidity, while CEXs control what assets are listed and delisted;

- DEXs execute trades instantaneously and do not require the custody of user funds, while CEXs require participants to deposit their assets and trust that execution is fair and orderly;

- DEXs have their source code and contracts publicly available for anyone to inspect, while CEXs are closed-source, and their inner workings are kept secret;

- DEXs orders and trade flow are completely transparent and accessible by everyone, while most Centralized Exchanges require additional fees for access to real-time market data.

- DEXs allow anyone to become a market maker and or provide liquidity to earn fees in a permissionless way, while each CEXs have strict membership requirements.

One of the most important advantages of DEXs, compared to CEXs, that results from being completely transparent and not holding users’ funds is that they provide increased security and are less vulnerable to hacks and other cyber attacks, including funds being stolen by insiders.

Historically, there has been a long string of hacks and customer funds losses in centralized exchanges, including the following:

- 2022 FTX – $9B

- 2021 Bitmark – $196M

- 2020 Kucoin – $281M

- 2019 Binance – $570M

- 2019 QuadrigaCX – $190M

- 2018 Bancor – $24M

- 2018 Zaif – $60M

- 2018 Coincheck – $534M

- 2016 Bitfinex – $72M

- 2014 Mt.Gox – $460M

- 2011 Mt.Gox – $400k

Another important aspect of DEXs is that they allow for some privacy. This may not always be a desirable attribute (e.g., when used by bad actors), but in general, privacy is an important human right, as is the ability to trade freely and without intermediaries.