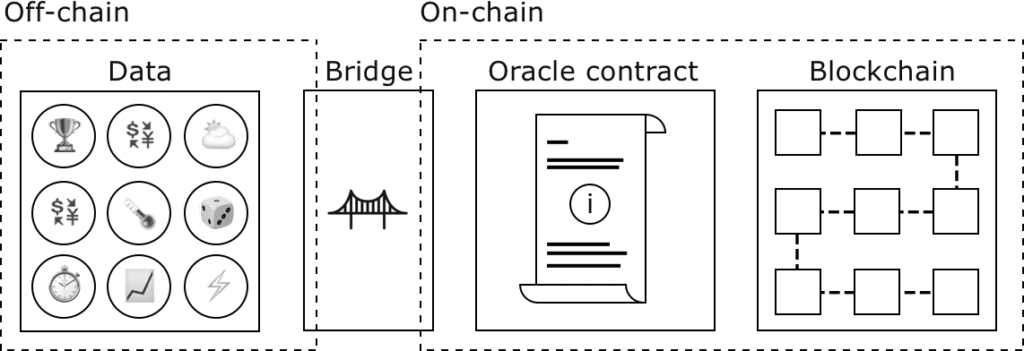

In DeFi, an oracle can refer to a smart contract that stores real-world data, such as asset prices, exchange rates, sports scores, weather data, etc. Alternatively, an oracle can also refer to an entire ecosystem and associated services that bridge data between on-chain and off-chain.

Oracles are an important part of decentralized finance because they enable smart contracts and dApps to make informed decisions and execute actions based on real-world information.

While Oracles offer several advantages, they also come with disadvantages. One of the biggest risks is that oracles can be hacked or manipulated. If an oracle is compromised, it could provide smart contracts with false or misleading data, leading to financial losses for users of DeFi applications.

Another risk is that oracles could become centralized. If a single oracle provider or network becomes too dominant, it could give that provider too much control over the DeFi ecosystem, which could lead to censorship or other problematic situations.

Because oracles are essential for the growth and development of DeFi, DeFi developers are working on several ways to mitigate the risks associated with single sources of truth. One approach is to use decentralized oracle networks. These networks comprise multiple Oracle providers and use consensus mechanisms to ensure that their data is accurate and reliable.