DeFi book describes DeFi as short for Decentralized Finance. DeFi combines blockchain technologies with smart contracts to create a novel financial ecosystem. This new ecosystem replicates and complements many existing financial services and products. It also enables a completely new set of innovative services and products that are available to anyone, anywhere, at anytime!

In DeFi, participation is permissionless, and anyone is free to join. Anyone can also issue new tokens and trade them as they wish. These tokens can represent anything from currencies, properties, special rights or accesses, artwork, or any asset class, whether physical or digital.

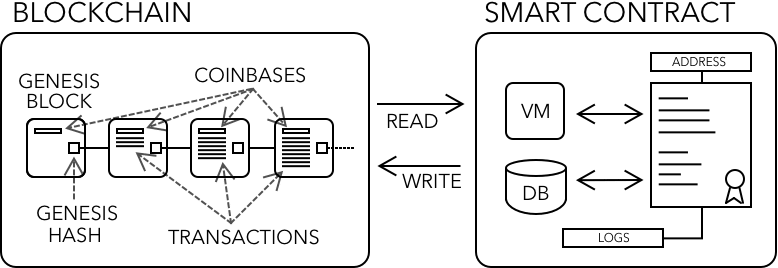

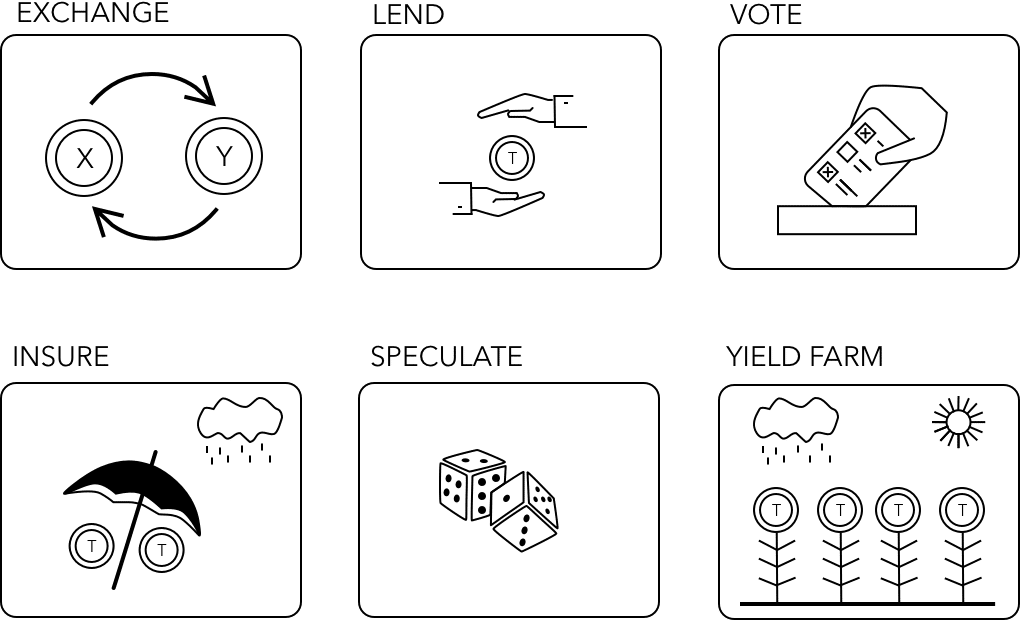

In addition to creating tokens, it is also possible to deploy smart contracts that replicate existing traditional financial services or create entirely new services.

This combination enables financial services such as issuance of tokens, transfers, exchanges, lending, insurance, market makers, brokers, and a myriad of derivate products, some of which are unique and only possible with this new type of finance (e.g., Flash Loans).

One compelling aspect about DeFi is the ability to bring together a multitude of tokens and smart contracts and perform simple or/and very complex economic interactions within the same instant.

Tokens and their operations are stored and computed openly so that anyone can trace and verify their origin and evolution.

Compared with Traditional Finance (TradFi), DeFi can massively reduce costs, execution time, enable new financial freedoms, and provide unprecedented new types of economic innovations. However, it also comes with many known and unknown risks as well as new opportunities.