In crypto, the meaning of staking describes the action of locking tokens with the expectation of earning returns.

There are two fundamentally different forms of staking tokens:

- In one form, the tokens are put to work and are at risk (e.g., as collateral for a particular activity, such as Proof-of-Stake (PoS), lending, etc.).

- In other forms, tokens are simply removed from circulation (e.g., to enable the token’s price to appreciate due to reduced supply).

Historically, the meaning of staking evolved as a solution to the problem that arises from open protocols that use Proof-of-Work (PoW) as the consensus mechanism. In these types of protocols (e.g., Bitcoin, Ethereum, Dogecoin, Litecoin, etc.), anyone can easily join the network and become a validator. This openness also allows malicious agents with disproportionately large enough mining capacity (i.e., hashing power) to disrupt the regular operation of such protocols.

This type of risk, commonly known as 51 percent attack, is relatively low for large and established protocols. But, it can be very high for small protocols that are still bootstrapping with constrained (mining/hashing) resources. To mitigate this potential attack vector, some protocols adopted a scheme whereby validators are required to have a stake in the protocol. This type of consensus mechanism became known as Proof-of-Stake (PoS).

In PoS protocols, when a validator misbehaves, his stake (i.e., tokens) is taken away. Eventually, this misbehaving validator runs out of tokens and is prevented from participating. Punishing a validator by taking away their stake is known as slashing. Slashing can occur if the validator becomes adversarial and if they fail to meet other expectations such as a minimum uptime, latency, version number, etc.

In both PoS and PoW protocols, the validators get rewarded for protecting their blockchain, validating new transactions, and executing any required logic (e.g., smart contracts). These rewards create the incentive for validators/miners to come together and collaborate in mining pools. Depending on the relative size of these pools and the reward structure of the mining fees of the protocol, these pools typically generate a predictable yield/reward.

Therefore, in Proof-of-Stake protocols, staking tokens is a form to earn a rewards/yield as long as the provided tokens are used as collateral by a compliant validator.

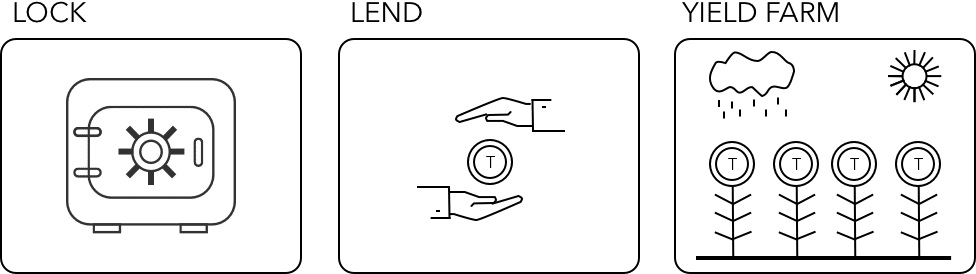

With the advent of DeFi, the concept of staking was extended to encompass another meaning. In this new context, staking can simply mean that tokens have been deposited or locked into a particular smart contract/project with the expectation of being rewarded some yield or reward.

Staking or depositing/locking tokens into a smart contract may be useful in several ways. For example, to:

- align the interests of a holder with the underlying project;

- provide liquidity to a decentralized exchange or lending pool; or

- remove these tokens from circulation and reduce their supply to push their price up.

Staking has also become a cornerstone of many Ponzinomics projects that promise high returns by giving rewards in a rapidly depreciating token. In these schemes, the early stakers may generate profits but only at the expense of later stakers/depositors.

When looking at staking schemes that promise positive yields, it is important to understand the source of these returns and how the staked tokens are involved in generating these returns. It is also prudent to understand the wide array of risks involved.

Staking risks can range from user errors (e.g., sending the tokens to the wrong contract, losing private keys, etc.), technical or hacks errors (e.g., contract bugs or oversights, etc.), or misaligned tokenomics/incentives (e.g., deliberate rug-pulls, Ponzis, and other scams).

Engineering staking schemes that decide how the underlying assets are applied and how to distribute any rewards is an exciting new subfield of DeFi and Tokenomics. It is likely to become an important tool in socio-economics.