The acronym NFTs refers to Non-Fungible-Tokens. NFTs represent unique assets with properties that are not replaceable. These tokens contrast with Fungible Tokens that can be easily interchanged with another equal or similar asset (e.g., a cryptocurrency).

NFTs became popularized with digital art projects like CryptoKitties (2017), CryptoPunks (2017), Bored Ape Yacht Club (2021), and the record-setting Beeple’s artwork Everydays (2021) that sold for 69 million dollars.

Although NFTs got popularized via artworks, their use-cases are far-reaching, and we have only scratched the surface of their vast applications.

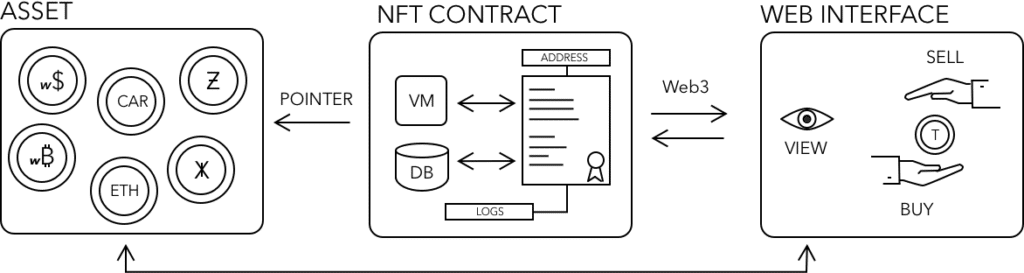

At the core, an NFT represents an association of an asset (physical or digital) and its owner. This association is described as an entry on a public ledger (i.e., a blockchain). This ownership can be easily verified, transferred, or transacted transparently, anytime, anywhere, and without intermediaries.

In many respects, most assets are already recorded and transacted via digital representations (e.g., company shares, land registries, vehicle ownerships, etc.). NFTs are no different, except they are visible on a globally readable open database/ledger that empowers owners to transact as they wish.

Since the ownership of NFTs can be verified anytime and from anywhere, they have also become a new cultural phenomenon where owners can signal their associations or/and memberships transparently and reliably. These memberships have enabled communities to flourish around certain tokens creating valuable networks that align incentives and foster multiple synergies.

In the near future, we will see many more physical items being tokenized and traded directly via Web3 interfaces. Furthermore, now that digital assets can also have verifiable ownership, new digital classes of goods and services emerge and be traded.