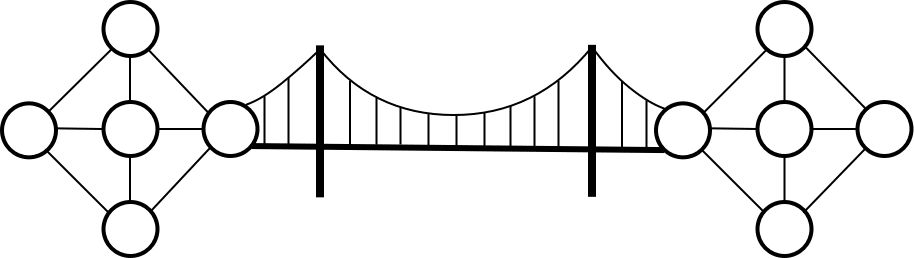

A crypto bridge is a technology that enables users to transfer digital assets from one blockchain to another.

Crypto bridges are often used to enable interoperability between different blockchain networks, allowing users to take advantage of each platform’s unique features and benefits.

These features or benefits can include: lower transaction fees, faster settlement times, richer sets of dApps that can interoperate together, assets only available on particular chains, increased liquidity, higher security or stability, etc.

In reality, bridged assets do not actually cross from one chain to another but are instead locked on the origin chain, and a representative token is minted on the destination chain, and ownership is given to the intended owner.

When the token is bridged-back to the originating chain, the representative token is burned, the original asset is unlocked, and its ownership is attributed to the intended owner.

Usually, a bridged token will have a name that is slightly different than the original token. For example, when Bitcoin (BTC) is used on the Ethereum chain, it takes the name of wBTC to distinguish it as being a wrapped version of Bitcoin.

The price of wrapped assets is usually a shred lower than the original asset, mainly because of increased risks and fees needed to unbridge.

Crypto Bridges depend on a messaging mechanism to allow both sides to coordinate. This mechanism can be a weak link that, once exploited, can lead to massive loss. This is because, on one side, assets can be released to the wrongful owners, and on the other, assets can be minted without being backed on the other side.